De Minimis suspended globally

Effective August 29, imported goods sent through means other than the international postal network that are valued at or under $800 and that would otherwise qualify for the de minimis exemption will be subject to all applicable duties.

For goods shipped through the international postal system, packages will instead be assessed duties according to one of the following methodologies:

Ad valorem duty: A duty equal to the effective tariff rate imposed under the International Emergency Economic Powers Act (IEEPA) that is applicable to the country of origin of the product. This duty shall be assessed on the value of each package.

Specific duty: A duty ranging from $80 per item to $200 per item, depending on the effective IEEPA tariff rate applicable to the country of origin of the product. The specific duty methodology will be available for six months, after which all applicable shipments must comply with the ad valorem duty methodology.

Longstanding exemptions under 19 U.S.C. 1321(a)(2)(A) and (B) remain in place—meaning American travelers can still bring back up to $200 in personal items and individuals can continue to receive bona fide gifts valued at $100 or less duty-free.

What is De Minimis?

The De Minimis Tax Exemption is a law that Congress passed on a bipartisan basis that allows shipments bound for American businesses and consumers valued under $800 (per person, per day) to enter the U.S. free of duty and taxes. (Source: National Foreign Trade Council)

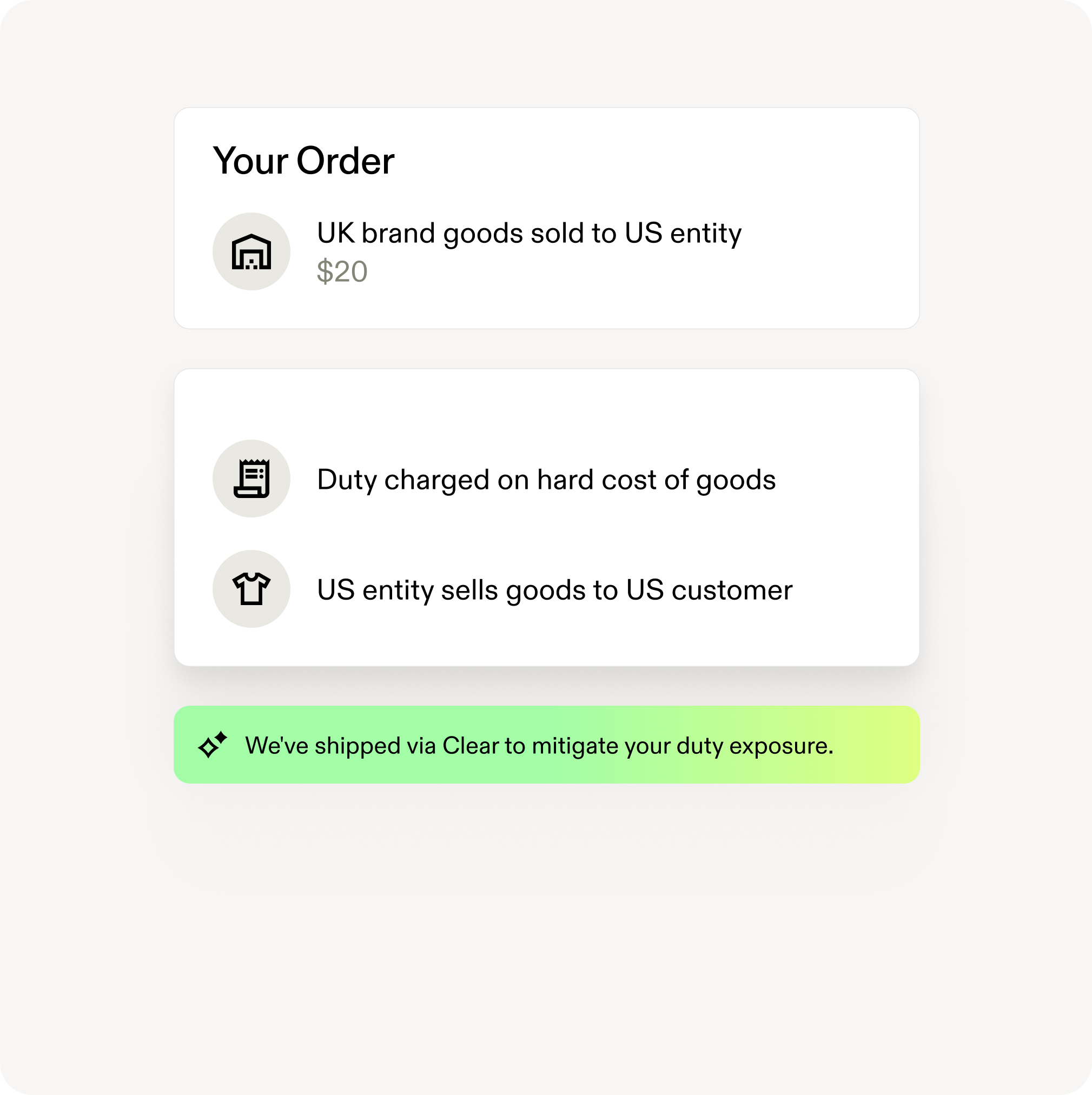

How Swap can help you stay compliant

Swap is your trusted partner in navigating global tariff complexities.

- All orders calculated in the checkout to account for total landed cost based on current guidelines—including new U.S. tariff rules, flat-fee postal duties, and country-specific rates

- Tax compliance covered to ensure your business remains in good standing with U.S. government and Customs and Border Protection (CBP).

- Customers can continue to receive packages DDP with all duties, taxes, fees and tariffs paid at checkout—avoiding customs delays and surprise charges at the door.

Book a free, 15-minute demo with a real human person

See your operations streamlined by the power of Swap.